Bei der Allianz haben wir uns schon früh damit auseinandergesetzt, wie wir mit dem uns anvertrauten Kapital einen Beitrag für eine nachhaltige Zukunft leisten können.

Deshalb haben wir uns bereits 2014 zu konkreten, messbaren Nachhaltigkeitszielen für unser Portfolio verpflichtet.

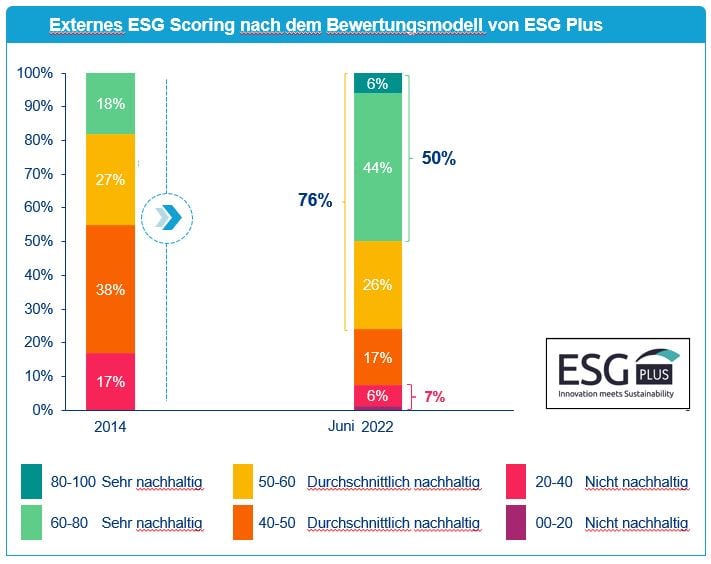

Von 2014 bis Mitte 2022 haben wir unseren Fortschritt jährlich von der österreichischen Ratingagentur ESG Plus unabhängig überprüfen lassen. In diesem Zeitraum konnten wir den Nachhaltigkeitsgrad unserer Investitionen im Bewertungsmodell von ESG Plus signifikant steigern.

Auf Basis dieses Bewertungsmodells von ESG Plus wurde die ESG-Performance unserer gesamten Kapitalanlagen der Allianz Elementar Versicherungs-Aktiengesellschaft und der Allianz Elementar Lebensversicherungs-Aktiengesellschaft in den vier gängigsten Wertpapier-Klassen Staatsanleihen, Unternehmensanleihen, Aktien und Pfandbriefe, für die das Asset Management in der Allianz Invest Kapitalanlagegesellschaft mbH erfolgt, erfasst.*

Das Fondsmanagement unserer Allianz Invest Kapitalanlagegesellschaft mbH verwaltete im Bewertungsmodell von ESG-Plus per Juni 2022 Kapitalanlagen von rund 4,4 Milliarden Euro aus der Sach- und Lebensversicherung. Der Anteil, der von ESG Plus als „sehr nachhaltig“ bewertet wurde, lag zuletzt bei 50 Prozent. Die nach diesem Modell „nicht nachhaltigen“ Anteile dieses Portfolios konnten 2014-2022 von 17 Prozent auf 7 Prozent verringert werden.