Bei der Allianz denken wir Nachhaltigkeit seit jeher ganzheitlich. Von unserem sozialen Engagement über eine ökologische Ausrichtung unserer Geschäftstätigkeit bis hin zu Nachhaltigkeit unterstützenden Produkten und Dienstleistungen.

Aber unser wichtigster Hebel sind unsere Kapitalanlagen. Weil es einen großen Unterschied macht, ob ihr Prämiengeld in nachhaltige Investitionen wie erneuerbare Energien, Gesundheit oder moderne Technologien fließt, oder aber in problematische Bereiche wie Kohleabbau oder die Rüstungsindustrie.

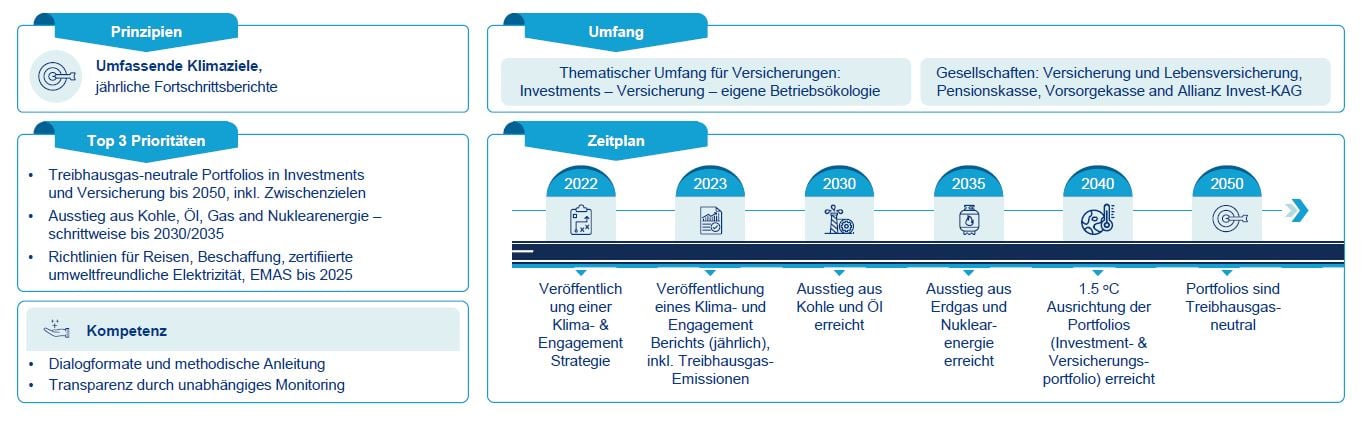

Als Vorreiter am österreichischen Markt haben wir uns bereits 2014 zu konkreten, messbaren Nachhaltigkeitszielen für unsere Kapitalanlagen verpflichtet. Unser Ziel ist heute klar: Die Ausrichtung unserer Portfolios am 1,5 Grad Ziel des Pariser Klimaabkommens und Treibhausgas-neutrale Portfolios bis 2050.